A Constitutional Obligation to Count All Persons

The census determines the distribution of more than $1.5 trillion in federal funds, grants, loans and loan guarantees, and support to states, counties, and communities. It is estimated that over a 10-year period, communities lose an estimated $18,250 for each person who is not counted in the census. House of Representatives districts are apportioned based on the decennial census. There’s a lot riding on this undertaking.

To get as complete a count as possible, the Census Bureau depends on the work of census takers. These employees are in the field now, following up on people who have not returned their form or completed it online or by phone. Now they will have less time to finish. And with covid-19 a major concern, many census takers have quit or failed to show up, leaving more work for fewer workers and more doubt that there will be an accurate tally by the end of September.

It has always been difficult to get a complete count, especially among historically undercounted groups such as racial and ethnic minorities, undocumented immigrants, people who are low-income or homeless, and people with limited English. It’s up to the census takers to persuade reluctant residents to give up their information to the government. Under the current administration, this can be a hard sell, especially for undocumented immigrants.

An undercount of people of color and lower income people will tip political representation and federal aid away from these populations.

Census counting usually wraps up at the end of July in order to meet the statutory December 31 date to report the population counts to the president. Last spring, the bureau asked Congress to postpone that deadline to April 30, 2021 to ensure the “completeness and accuracy of the 2020 Census.” The coronavirus relief bill passed by the House of Representatives in May (the HEROES Act) includes a provision to extend that date as requested, but the Senate has not acted on that bill or this issue. The bureau will find it hard to make the December 31 deadline, even with a September 30 end to counting, trying to squeeze five months of data checking and processing work into three.

President Trump supported the extension of the census collection dates into the fall when that was proposed last spring, but has apparently changed his mind; it’s not certain that he will be in office at the end of April, so he wants the results delivered to him at the end of December.

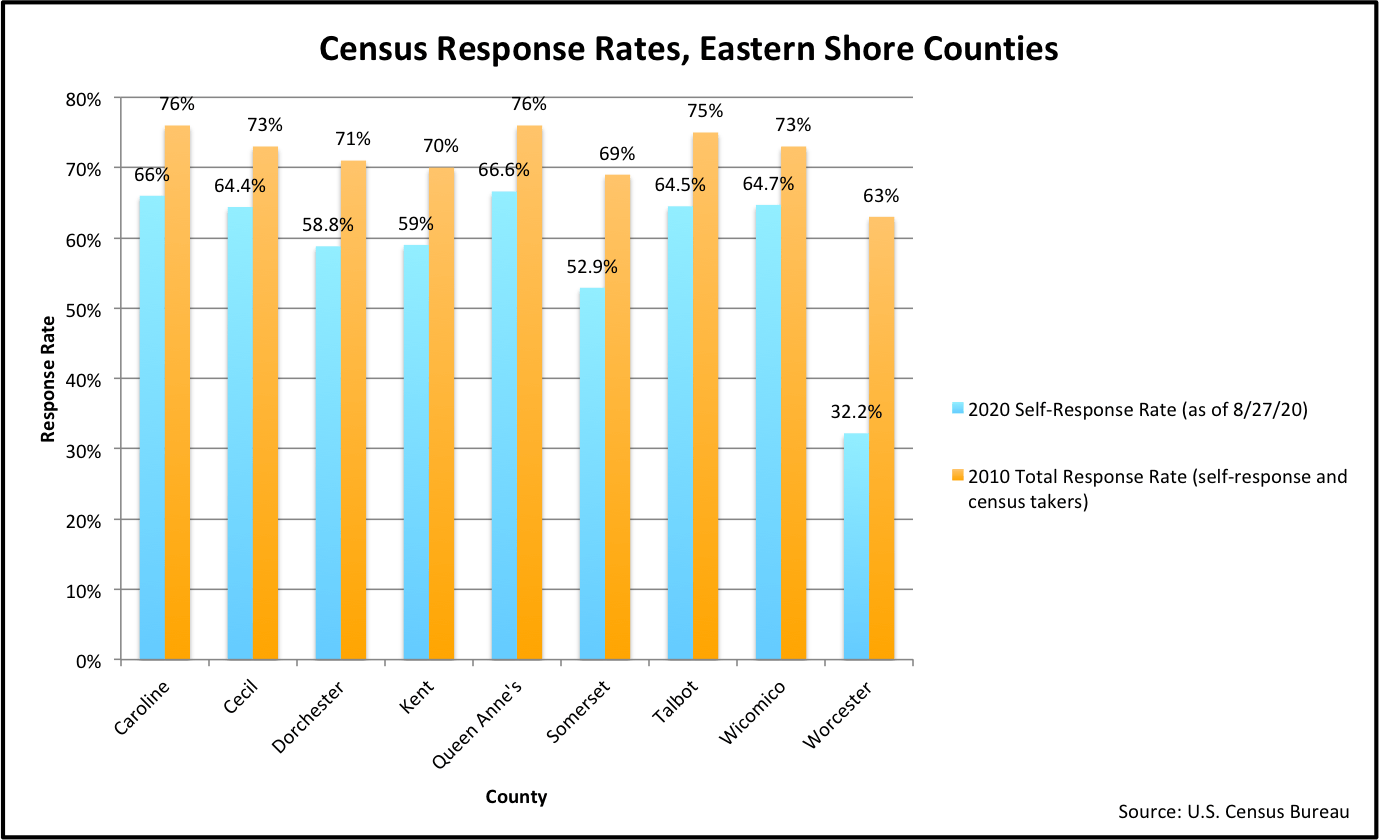

In the chart above we can get a sense of the importance of the work of census takers:

- The blue bars represent the current 2020 self-response rate for each county. Self-response includes mail, online, and phone responses initiated by the person being counted.

- The yellow bars represent the 2010 census total response rate. Total response includes self-responses and responses collected by census takers.

- The difference between the blue and yellow bars is pretty much the amount of work the census takers need to do in order to equal the response rates from 2010.

In 2010, the work that census takers did made a big difference to Eastern Shore counties — response rates in most counties were increased by anywhere from 6 percent to 15 percent.

As of August 27, the national response rate was 80.1 percent; 15.4 percent is due to census workers. The Maryland rate was 85.4 percent; 16.3 percent is due to census workers. Total response rates by county are not yet available.

The bureau also announced that it will act on Trump’s constitutionally questionable memorandum to exclude undocumented immigrants from the final enumeration for the purpose of congressional apportionment.

The result of this maneuver would be to reapportion the 435 House seats to benefit states with lower undocumented populations (such as Alabama), and harm states with higher undocumented populations (such as California). This scheme is only the latest by the administration to manipulate the census to its benefit.

The Constitution, however, is clear that the census must count “the whole number of persons in each State” (14th Amendment, Section 2). Lawsuits have already been filed to prevent undocumented immigrants from being eliminated from the state population counts for apportionment.

It is clear that the Trump administration does not want a complete census count. It seems doubtful that Congress will quickly pass an extension for the 2020 Census to prevent a fiasco that will have lasting consequences. The courts may have to deal with the fallout.

(If YOU haven’t responded yet, go to https://my2020census.gov/.)

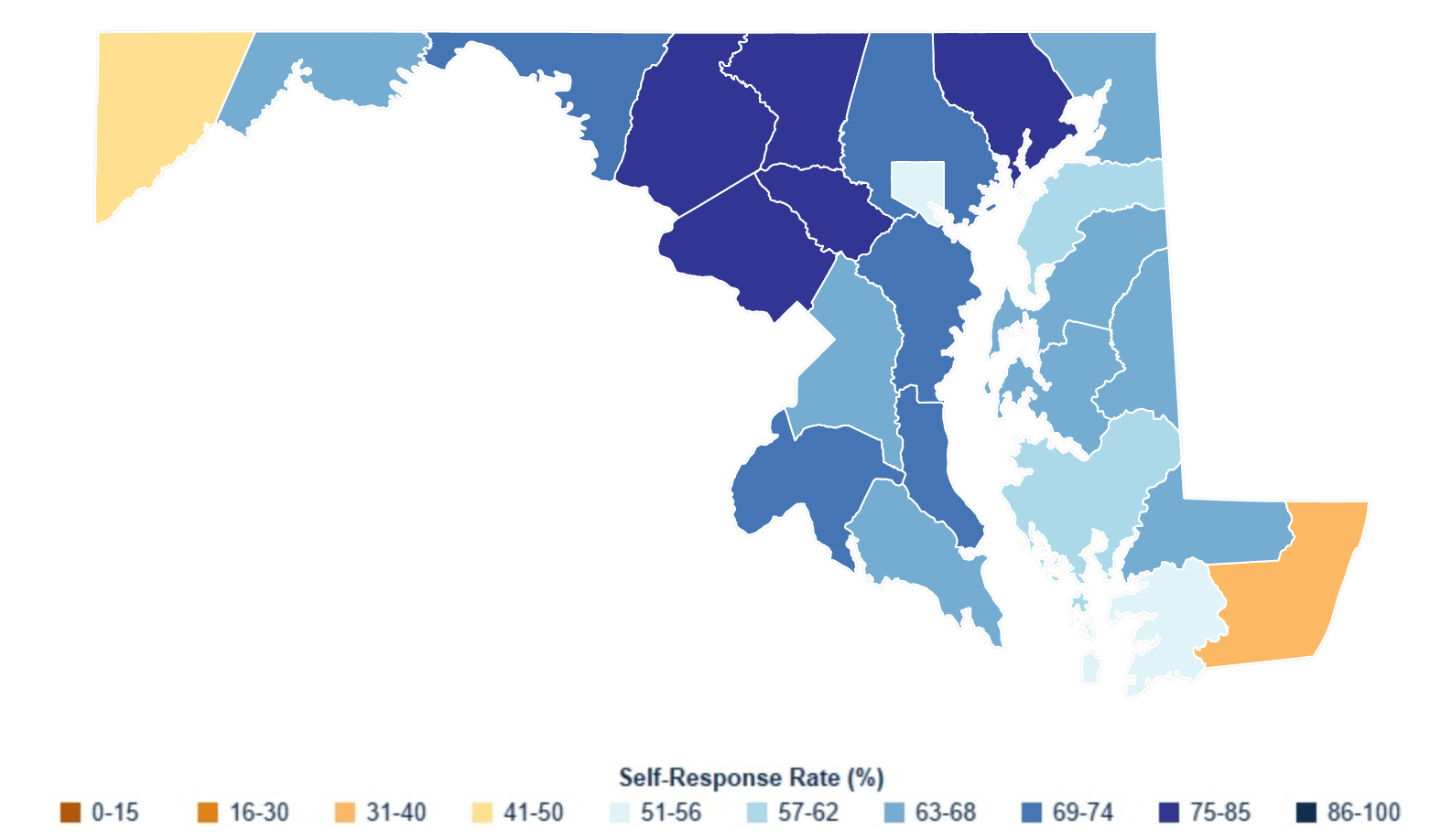

Self-Response Rates – 2020 Census:

NOTE: Officials in Worcester County attribute that county’slow response rate to the large number of vacation homes in the Ocean City area.The Maryland Department of Planning applies an adjustment of about 29.1 percent tooffset these unoccupied dwelling units, which brings Worcester’s response rateup to 61.3 percent. The 2010 final response rate for the county adjusted forunoccupied dwelling units.

2020 Census Self-Response Rates

2010 Census Participation Rates

State by State Total Response Rates

Maryland Census Response at a Glance

Jan Plotczyk spent 25years as a statistician with the federal government, at the Census Bureau andthe National Center for Education Statistics. She retired to Rock Hall.

Common Sense for the Eastern Shore