Immigration and the Past and Future of America

Introduction:

Immigration (legal and illegal) has been a highly emotional and divisive issue for a number of years, but particularly during the first 18 months of the Trump Administration. There have been various efforts to stop or limit entry of people into the US: immigrants from Muslim majority countries, the “Dreamers” who were brought to the US as young children by their undocumented migrant parents, and refugees from Central America.

Many Americans have been shocked by the impact of the Administration’s Zero-Tolerance approach that resulted in several thousand children being separated from their parents. In August 2018 more than 400 children still have not been returned, despite court orders to reunite the families. And the White House continues its efforts to build a large, $25 billion wall on the Southwestern border to keep people out. All of these actions have been, and are still being, addressed by Federal courts, while legislation aimed at resolving the most urgent immigration issues has stalled or failed in Congress.

These are familiar and fraught subjects. The following paragraphs set them aside and briefly describe the history of Americans’ shifting moods about foreign migrants and address the contributions immigration has made to the country.

America, the Land of Immigrants:

The nation’s founders — as well as their parents and grandparents — immigrated to the American colonies from Europe for many reasons: to avoid religious persecution and violence for many, to escape a rigid social structure and/or debtors’ prison for many others. But most of all, they came for a fresh beginning, a chance for a better, happier life. Similar motivations have attracted millions of additional immigrants to the United States down to the present day. During the 1700s and early 1800s, US immigration was largely free and open.

Today in 2018, many older Americans still recall the arrival of Cubans in the 1950s and ‘60s, of Koreans, then Vietnamese beginning in the 1970s, and more recently immigrants from Iraq, Syria and Afghanistan, as well as other Middle Eastern and African countries. Many who witnessed these immigrants arriving — along with the politicians and policy-makers of the era — understood the magnetic appeal the USA exerts on desperate people and they accepted the humanitarian need as well as the economic and demographic benefits of accepting these newcomers as part of the American spirit and tradition. But now the prevailing attitude on immigration may be shifting back to something more hostile, something last seen in the late 19th and early 20th Centuries.

America, Immigration and Early Brush with Terrorism:

Sept. 11 was not this country’s first experience with foreign terrorism. More than 100 years ago, divisive European political ideologues, e.g., socialists, anarchists and reds, fueled by hyper ethnic/national grievances, launched riots and considerable unrest across Europe. Kings, princes, queens, and empresses were felled by bombs and pistols. And some immigrants brought these convictions and their violent eruptions to the US.

In 1901 US President McKinley was killed by Leon Czolgosz, a recent Eastern European immigrant who said he had been inspired by Emma Goldman, an Anarchist and a Jewish immigrant to the United States. Anti-Semitism, always latent, re-emerged as a problem. The following list of Federal legislation reflects America’s changing attitudes on immigration from the early 1900s to the current day.

1907 Immigration Act:

- Doubled immigration tax

- Banned most Asian immigrants

- Broadened definition of “undesirable alien” to include uneducated, ill (physical or mental) and those likely to need public assistance

Dillingham Commission (1907-11):

- Favored more sanctions on immigrants

- Discriminated against Southeastern European immigrants

1917 Immigration Act:

- Doubled immigration tax again

- Introduced English literacy test for those over 16

1921 Emergency Quota Act:

- Reduced immigration by 75%

- Established quotas for countries of South and Eastern Europe

1924 Johnson Reed Immigration Act:

- Restrictive quotas on Southern and Eastern Europeans based on 1890 census instead of the 1910 census

- Excluded both Asian and black immigrants

- Severely limited Jewish immigration

1939 SS St. Louis Incident:

- US refused to allow 900 German Jews to disembark from the liner SS St. Louis

- Some 350 were returned to Germany and about 1/3 died in concentration camps

1965 Immigration and Nationality Act passed

- Reflected much changed, more welcoming, public attitude towards immigration

- Removed the 44-year-old national origins formula

- Ended ethnic, religious and geographic discrimination

- Created visa preferences based on immigrants’ education, skills and family relationships

2017-present

- Administration working to limit family members to spouse and minor children

- Administration wants to cut substantially the number of immigrant visas issued

Recent data from the Department of Homeland Security illustrates that far from a massive flood of illegal aliens attempting to cross the US/Mexican border, the numbers are at historic lows.

America’s Growth and the Immigrant Role:

Essentially, without immigrants, the US population would have stopped growing in the early 1970s. There are three factors: (1) native-born women began having fewer babies, (2) the US death rate dropped but (3) net immigration (minus emigration) was large enough to reverse the decline in birth numbers, while the influx of younger people countered the natural aging of the native population. Without this impact, Social Security, Medicare and Medicaid — as just a few examples — would not have been supportable without the many billions of dollars these immigrants added to national and local tax revenues over the years. And without continued immigration, our population would age, engendering the problems that now confront Japan, Europe, Russia, and, soon, China.

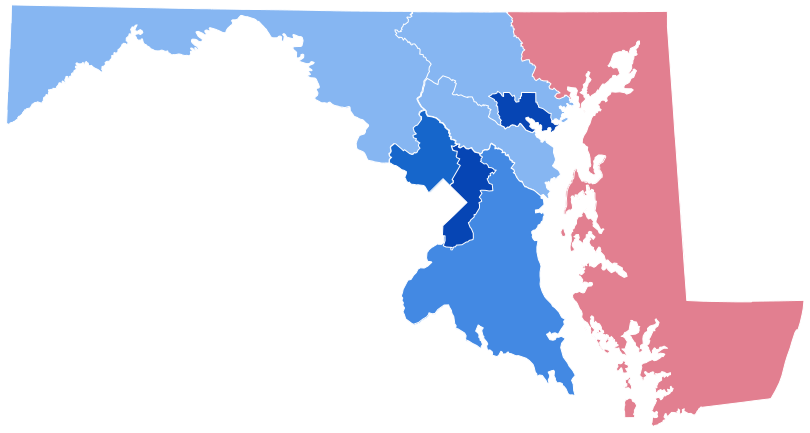

Common Sense for the Eastern Shore