Maryland General Assembly Wrap-up, Part 2: New Firearms Legislation

During the Maryland General Assembly’s 2023 session from January 11 to April 10, members considered a total of 2,275 bills. After the usual rounds of discussion, lobbying, and committee work — and maybe a little horse-trading — over 800 bills were enacted and sent to Democratic Gov. Wes Moore. Moore himself sponsored 10 bills, all of which were enacted — although some with amendments.

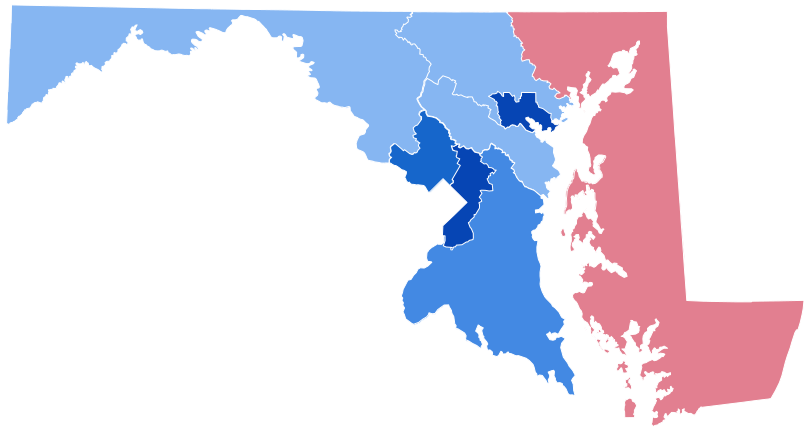

In this second installment of our legislative wrap-up, Common Sense for the Eastern Shore looks at changes to the state’s firearms laws.

The new firearms laws were motivated in part by the nationwide epidemic of mass shootings. Between January 1 and April 20 just this year, 169 mass shootings — defined by the Gun Violence Archive as events where at least four people, not including the shooter, are killed or wounded — took place in the U.S. Six of these shootings occurred in Maryland.

While those statistics are sobering, they don’t include the much larger number of incidents where fewer than four people were killed or wounded by firearms — either intentionally or accidentally. The Gun Violence Archive reports that, as of April 20, 12,973 Americans died from gunshot wounds, including 7,392 by suicide. Only 327 of the incidents were defined as “defensive use” — a category frequently cited by gun advocates as justification for fewer restrictions on the availability of firearms.

New gun laws were passed primarily in response to the U.S. Supreme Court’s 2022 decision invalidating a New York law that required applicants for concealed carry permits to provide “a proper cause” for needing the license. The Gun Safety Act of 2023 allows owners of private property to decide whether firearms, concealed or otherwise, can be brought onto their property. This includes commercial establishments as well as homes. The law also designates “sensitive places” — schools, government areas, health care facilities, places where liquor or cannabis is sold, and sports or entertainment venues, to name a few — where carrying guns is prohibited. The law provides penalties of 90 days imprisonment and/or a $500 fine for a first offense, with repeat offenses subject to progressively harsher penalties.

In another measure, the legislature tightened up requirements for proper storage of firearms to prevent them from falling into the hands of minors. The new law prohibits leaving a loaded firearm or a firearm and its ammunition in a location accessible to an unsupervised person under 18. The bill includes a mandate for the state Secretary for Public Safety to establish an advisory committee to make recommendations as to safe firearm storage and youth suicide prevention.

Another bill increases the maximum fee for initial handgun permit applications from $75 to $125. Fees for renewal and duplication of existing permits will also rise. The measure also expands requirements for firearms training courses, and increases the age at which a person can lawfully possess a firearm from 18 to 21.

Republicans in the General Assembly argued that the new laws violate the Second Amendment of the U.S. Constitution. Advocates of gun rights have promised to challenge the new laws, predicting they will be struck down by the Federal courts. But the laws’ sponsors say there is ample historical precedent, dating as far back as the Colonial period, for limiting the ability of gun owners to bring their guns to a place against the wishes of the property owner or to bring them into certain sensitive locations.

Another new firearms bill enacted by the legislature requires the Maryland State Police Gun Center to screen and track all firearms surrendered under final protective orders issued by a court. The Gun Center would be required to report information on the firearms and on the owners of the surrendered weapons.

Whether these provisions will prevent the sorts of shootings recently in the news across the country — people shot for knocking on the wrong door or turning into the wrong driveway — remains to be seen. Advocates hope the new laws will at least reduce the number of guns in the community, and by doing so, reduce the chance that they will end up in the hands of those who do not use them safely and responsibly.

Peter Heck is a Chestertown-based writer and editor, who spent 10 years at the Kent County News and three more with the Chestertown Spy. He is the author of 10 novels and co-author of four plays, a book reviewer for Asimov’s and Kirkus Reviews, and an incorrigible guitarist.

Common Sense for the Eastern Shore