Maryland Residents Eligible for Free Medical Equipment

From the moment doctors said she would have to undergo intensive foot surgery, Prince George’s County resident Janice Joyner knew she would have to pay for more than just a procedure.

A mobility device was needed for her recovery. However, Joyner said, Medicare couldn’t cover the cost of the scooter.

“I was searching online for some kind of equipment that could help me and I didn’t want to pay an arm and a leg for it,” she said.

Janice Joyner in front of the Durable Medical Equipment Re-Use Headquarters

in Cheltenham, Maryland, on August 27, 2021. Photo: Program Director Ian Edwards

After numerous Google searches, she said she came across the Maryland Durable Medical Equipment Re-Use Program.

This program provides Maryland residents with donated equipment — such as wheelchairs, walkers, hospital beds, scooters, and even pediatric equipment that have been sanitized and repaired — at no cost.

Applicants do not have to meet any income requirements to receive equipment.

Marylanders with any disability, illness, or injury can receive this equipment regardless of age, according to the program website.

Joyner said she thought the program was too good to be true.

“At first I was skeptical [wondering] ‘Why is this place offering free resources?’” she said. “But everything on [the website] was true and I was amazed.”

Disability healthcare costs in Maryland can reach as high as $21,118 per person each year, according to a 2019 Disability and Health Data report the Centers for Disease Control and Prevention issued.

After a month and a half of mobility assistance, Joyner said, she plans on returning her scooter to the program's headquarters for another person to use.

“Before, I could only hop five steps to my bathroom and back,” she said. “Having this scooter made it possible for me to get out of bed.”

Ten percent of Maryland adults have a mobility-related disability, according to the CDC report.

This makes it the highest reported disability among other types such as cognitive, self-care, and independent living.

Program Director Ian Edwards said despite numerous attempts to raise awareness for this program, many people still don’t know it exists.

“We started things up last January, but with covid fears we weren’t really sure how the program would be perceived because [we offer] previously used equipment,” he said.

Once the majority of Marylanders received their vaccines, Edwards said more equipment started going out to the public in the spring.

“We faced a lot of difficulties at the start,” he said. “But the equipment is [now] here and we have it ready for people who have no other means of obtaining it.”

Edwards said the program has received over 5,000 items since collections began.

Although the program does not currently deliver, he said they have multiple satellite sites around the state where people can pick up equipment.

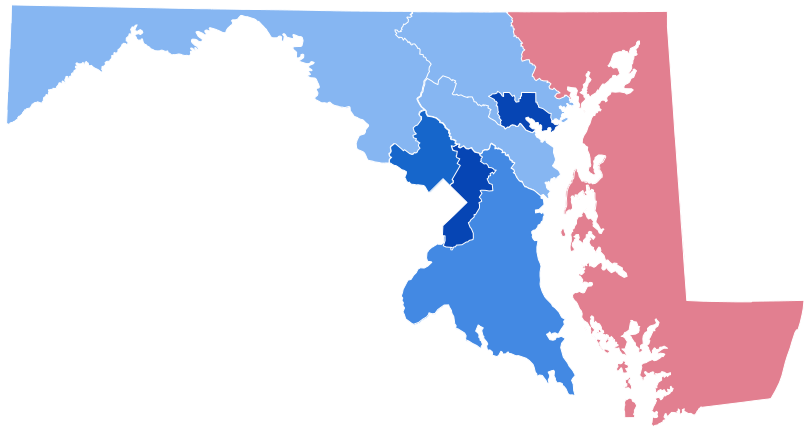

For the Eastern Shore, the pickup location (by appointment only) for basic durable medical equipment (DME) is at Delmarva Community Services in Cambridge. Complex DME must be picked up (by appointment only) across the bridge at the Cheltenham headquarters.

Basic DME includes:

- Canes, Crutches, and Walkers

- Rollators

- Shower Chairs and Tub Transfer Benches

- Bedside Commodes and Toilet Safety Rails

- Bedrails

Complex DME includes:

- Manual Wheelchairs

- Transport Wheelchairs

- Power Wheelchairs

- Power Scooters

- Home Hospital Beds

- Mechanical Lifts

The program also hosts 11 donation centers across the state, including three major landfills where people can drop off equipment.

Edwards told Capital News Service that they partnered with county landfills to set up containers and raise awareness for the re-use program.

He said while the program serves to help residents, they also want to ease financial strains among other contributors.

“Whether it's the healthcare system, hospital providers, or even Medicare,” he said. “If we can save them money, with the inventory we have now, we're hoping to help in any way.”

Secretary of Aging Rona Kramer said Maryland is the first state to offer this statewide durable reuse program.

“There are very few programs in the country that are this expansive,” she said. “We have the most sophisticated one. We are giving people their lives back.”

More information about the program: https://aging.maryland.gov/pages/DME.aspx

Capital News Service is a student-powered news organization run by the University of Maryland Philip Merrill College of Journalism. For 26 years, they have provided deeply reported, award-winning coverage of issues of import to Marylanders.

Common Sense for the Eastern Shore