Report Details Why Progress to Clean Up the Chesapeake Bay has Been Slow

The 133-page report released by the program’s Scientific and Technical Advisory Committee offers a range of findings about why progress toward those goals has been slow and why water quality improvements “are proving more challenging than expected.”

Among those findings are that pollution reductions from farmers have been insufficient, plans need to better take into account climate change and different habitats within the watershed with unique characteristics, and future conditions will impact the Bay differently in years to come.

Under the Chesapeake Bay Agreement, Virginia, Maryland, Pennsylvania, Delaware, New York, West Virginia and the District of Columbia agreed to meet specific goals to reduce pollution from entering the 64,000-square-mile watershed. Late last year, the Environmental Protection Agency acknowledged that the 2025 goals are not likely to be met.

While pollution reductions have resulted from upgrades to wastewater treatment plants, most of the remaining reductions must come from so-called nonpoint sources, or those that are spread widely over geographic areas. Nonpoint sources include runoff from agricultural fields, urban areas and impervious surfaces, explained report co-editor Kurt Stephenson, a professor of agricultural and applied economics at Virginia Tech.

“It is the major challenge confronting water quality management now and into the future,” Stephenson said. “Three-quarters of the [pollution] loads entering the Chesapeake Bay come from nonpoint sources. The largest majority is from agriculture.”

The report finds that existing efforts to reduce pollution from the agricultural sector through the use of best management practices have not been effective. According to the report, tens of millions of pounds of nitrogen reductions are needed to achieve the Bay water quality goals, but since 2010 best management practices have only produced 3 million pounds a year of nonpoint source reductions.

“The extensive history of nonpoint policy illustrates the limits of relying on voluntary actions,” the report states. “New and refined requirements … may be necessary to achieve substantial progress in reducing nonpoint source loads.”

Stephenson said that instead of instituting policies that incentivize farmers to implement certain practices, states could reward farmers for achieving greater pollution reductions.

Practices like planting riparian buffers “are highly cost-effective from a public standpoint in terms of getting reductions per dollar,” said Stephenson. “They can be highly effective. But nobody has any incentives to adopt things that have high upfront costs and no personal benefit.”

The report also finds nutrient reductions haven’t achieved the water quality improvements expected.

One reason for that is that “tipping points,” or periods when small changes yield big responses, haven’t been hit yet, explained Denice Wardrop, report co-editor, executive director of the Chesapeake Research Consortium and a professor of geography and ecology at Penn State University. Rising temperatures linked to climate change that offset roughly 6% to 34% of the nitrogen reductions that have occurred could also play a role.

“The Bay of the future is not the Bay of the past, and we have no historical precedent and model to go off of,” said Wardrop.

Improvements in resources like fish and wildlife populations can be achieved through additional management actions that don’t need to apply across all habitats, the report notes. Instead, states might embrace different reduction goals for different habitats or incorporate the benefits of restored wetlands or living shorelines into load reduction calculations.

Uncertainties lie ahead for the Bay, the report authors note, given climate change, population growth and economic development.

“Refining restoration goals over time should be considered as knowledge evolves about what future conditions are possible, what local communities and the partnership at-large see as priorities, and what is required to attain those possible futures,” the report says. “Uncertainty is inherent in each of these.”

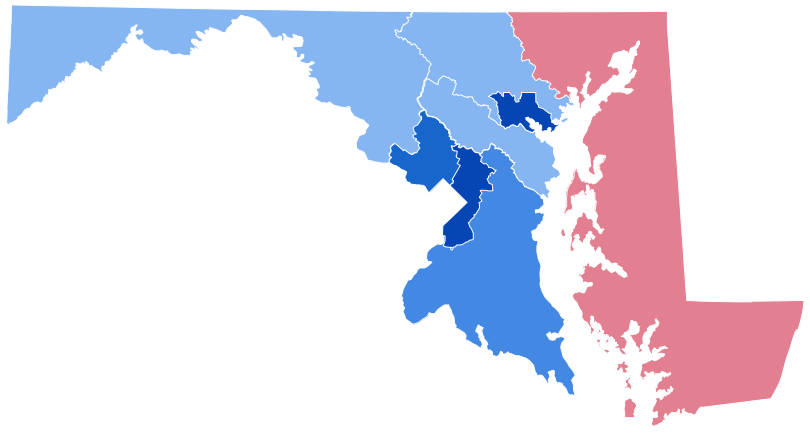

Common Sense for the Eastern Shore