Summary of Firearms-Safety Bills in 2019 Maryland General Assembly

Three gun-safety bills were enacted by the 2019 General Assembly:

1.Illegal Firearms Transfers

Without a definition of “transfer,” courts have accepted the argument that Maryland’s 1996 background check law did not apply to a “loan.” This allowed anyone to engage in illegal transfers or straw purchases and then argue they didn’t violate the law. The new law closes this loophole by preventing loans to prohibited people and to anyone intent on committing a crime. Although this bill was weakened in committee, it will support law-enforcement efforts to keep guns away from the underground market.

2.Study to Trace Illegal Guns

This law requires the Governor’s Office of Crime Control and Prevention to conduct a study to pinpoint where guns used in crimes originate, determine how these guns enter the underground market, and identify loopholes in existing laws. Firearms-safety advocates can use this information to develop policy proposals and better understand how well current laws are being implemented. This law was prompted because:

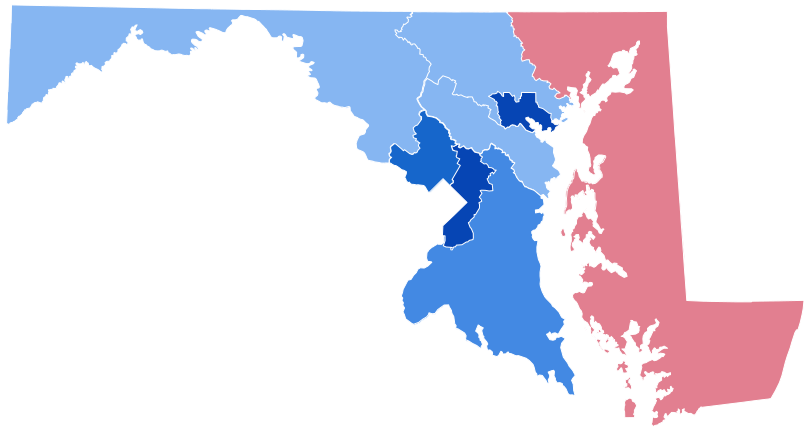

- Although Maryland has strong gun laws, it’s surrounded by states with looser laws;

- Loopholes in the federal system make it possible to divert guns into the illegal market; and

- It is imperative to understand how guns enter Maryland in order to stem the flow of these firearms.

3.Handgun Permit Review Board

The Handgun Permit Review Board was created to rule on appeals after a wear-and-carry permit applicant is refused a permit by the Maryland State Police. The Board consists of five citizens nominated by the governor and confirmed by the State Senate. Over several years, volunteers monitoring the Board documented a dramatic increase in reversals of State Police rulings by Hogan-appointed Board members. During 2018, the Board reversed the State Police 86 percent of the time. With the Board terminated, judges in the Office of Administrative Hearings would hear and rule on all appeals. NOTE: Not unexpectedly, Governor Hogan has vetoed this bill, saying, “it is just another in a long series of politically motivated and ill-conceived power grabs.” However, because a veto-proof majority in both chambers enacted this bill, it’s likely this veto will be overturned when the legislature convenes in January 2020.

Other Firearm Legislation Considered in the 2019 Maryland General Assembly:

Surprisingly, a bill to prevent access to firearms by children failed in committee. This bill aimed to strengthen existing safe-storage requirements for firearms accessible to an unsupervised child, and to increase the age of “child” from under 16 to 18; it will undoubtedly be re-introduced in 2020. Two other bills also failed, one to close the “long-gun loophole” by requiring background checks for sales of rifles and shotguns and the second to ban “ghost guns” (firearms assembled from a kit without a serial number) and “3-D guns” printed on a computer.

Here’s how Marylanders to Prevent Gun Violence summarized the session: “Our opponents introduced over 20 bills this session that, if enacted, would have weakened Maryland’s strong gun laws. MPGV prevented all of them from passing. MPGV focused on fighting the gun lobby’s top priority: weakening our state’s concealed carry standards. We defeated bills that would have weakened our concealed carry permit standards by allowing an unverifiable claim of self-defense to become a ‘good and substantial reason’ for issuing a permit. Currently, a person is required to show documentation of a specific threat against him- or herself in order to meet the standard. The proposed changes would have substantially weakened our strong wear-and-carry permit standards and would have dramatically expanded the number of people permitted to carry a firearm in Maryland. The gun lobby will be back in force to fight for this bill again next year. We must remain vigilant.”

The principal organizations advocating for gun safety at the General Assembly are Marylanders to Prevent Gun Violence and Moms Demand Action/Everytown for Gun Safety. The Gifford Law Center and the Coalition to Stop Gun Violence provide support to these groups. This article is based on MPGV’s wrap-up report.

MPGV: mdpgv.org

Moms Demand: momsdemandaction.org

Gifford Law Center: lawcenter.giffords.org

Coalition to Stop Gun Violence: csgv.org

Gren Whitman is the Acting Chair, Kent County Citizens to Prevent Gun Violence

Common Sense for the Eastern Shore