Supreme Court Watch: Gun Regulation

John Christie • March 2, 2020

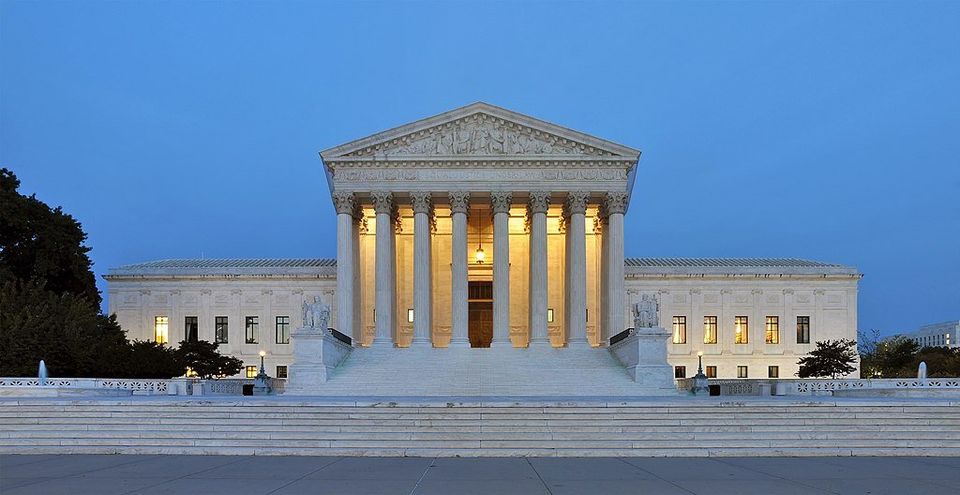

In June 2008, the Supreme Court narrowly ruled that the Second Amendment protects a person’s right to possess a handgun and use it for traditionally lawful purposes, such as self-defense within the home (District of Colombia v. Heller). Writing for the majority, Justice Antonin Scalia characterized handguns as Americans’ most popular weapon for home self-defense and concluded that a complete prohibition by the District was invalid. Scalia acknowledged, however, that “like most rights, the right secured by the Second Amendment is not unlimited.” The Second Amendment right, he added, was not a right “to keep and carry any weapon whatsoever in any manner whatsoever and for whatever purpose.”

Except for a later opinion that extended the Heller ruling to similar handgun prohibitions by states and local governments, the Court has not accepted a case for review involving other types of regulations on firearms since Heller. For 11 years, the justices have turned down requests to say more about the scope of the Second Amendment’s right to bear arms. That apparent reluctance has prompted complaints from Justices Clarence Thomas and Neil Gorsuch. For example, Thomas dissented from the Court’s announcement in 2018 that it would not review a challenge California’s 10-day waiting period for gun purchases, asserting that the right to keep and bear arms had apparently become the Court’s “constitutional orphan.” In Thomas’s opinion, the lower courts were “resisting” the Court’s decision in Heller and failing to protect the Second Amendment to the same extent as other constitutional rights were protected.

Against this background, the Court accepted a case for review a year ago involving a New York City law that limited the removal of handguns from the premises registered by the owner on the license (New York State Rifle & Pistol Association Inc. v. City of New York). The association and a group of gun owners who live in the city challenged the city’s ban on transporting their handguns from their city homes to second homes or shooting ranges outside the city without an additional license, restrictions they described as “draconian.”

As the case was beginning to be briefed for the Court, New York City officials moved to eliminate the challenged regulation, perhaps because of the prospect of a ruling that might expand the scope of Second Amendment rights. The city revised its rule and, in July, the state of New York passed a law that now permits licensed owners to transport their handguns directly to second homes, shooting ranges, or other authorized locations.

As the result of these changes in the challenged law, a new issue has been injected into the Supreme Court’s review. Article III of the Constitution extends federal judicial power to “cases” and “controversies.” Inasmuch as the plaintiffs have received all of the relief they might sought, does there remain a “case” or “controversy”? Or is the issue now moot?

When the case was argued before the Court in December, the mootness issue dominated exchanges between the justices and the lawyers on both sides. As a result, it is harder to predict how the Court will come out on the merits of the original Second Amendment issue should a majority determine that the case is not moot despite the changes in the law. A decision is expected by the end of June.

John Christie was for many years a senior partner in a large D.C. law firm. He specialized in anti-trust litigation and developed a keen interest in the U.S. Supreme Court, about which he lectures and writes.

Common Sense for the Eastern Shore

These are the words from Emma Lazarus’ famous 1883 sonnet “The New Colossus” inscribed on a bronze plaque on the pedestal of the Statue of Liberty. In 1990, Congress reaffirmed this vision of America by establishing the Temporary Protected Status program. TPS is designed to provide humanitarian relief to foreign nationals in the United States who come from disaster-stricken countries. In its present form, the TPS legislation gives the Secretary of the Department of Homeland Security responsibility for the program. However, the legislation prescribes the kind of country conditions severe enough to warrant a designation under the statute, the specific time frame for any such designation, and the process for periodic review of a TPS designation which could culminate in termination or extension. All initial TPS designations last from six to eighteen months. Before the expiration of a designation, the statute mandates that the Secretary shall review the conditions in the foreign state to decide if the conditions for the designation continue to be met, following consultation with appropriate agencies of the government. Extension is the default; the designation “shall be extended” unless the secretary affirmatively determines that conditions are “no longer met.” ------------------------------------------------------------- A massive earthquake devastated Haiti in January 2010, and precipitated an unprecedented humanitarian crisis. Shortly after, then-DHS Secretary Janet Napolitano, after consultation with the State Department, designated Haiti for TPS due to “extraordinary conditions.” Haitian nationals in the United States continuously as of January 12, 2010, could thus apply for TPS, and obtained the right to remain and work in the U.S. while Haiti maintained its TPS designation. Napolitano set the initial TPS designation for 18 months. As Haiti’s deterioration worsened, successive DHS secretaries have extended this program. Gang violence and kidnappings have spiked. In 2021, a group of assailants killed Haiti’s then-President Jovenel Moïse. In 2023, another catastrophic earthquake hit Haiti. In 2024, in response to these conditions, then-DHS Secretary Alejandro Mayorkas once again extended and redesignated Haiti for TPS, this time effective through February 3, 2026. During the 2024 election cycle, the GOP candidate, Donald Trump clearly indicated that time had not tempered his views on Haiti, characterized by him as a “shithole country” during his first term. He stated that when elected, he would “absolutely revoke” Haiti’s TPS designation and send “them back to their country.” On December 1, 2025, Kristi Noem, DHS secretary in the second Trump administration, announced, “I just met with the president. I am recommending a full travel ban on every damn country that’s been flooding our nation with killers, leeches, and entitlement junkies. Our forefathers built this nation on blood, sweat, and the unyielding love of freedom, not for foreign invaders to slaughter our heroes, suck dry our hard-earned tax dollars, or snatch the benefits owned to Americans. We don’t want them, not one.” So says the official responsible for overseeing the TPS program. And one of those (her word) “damn” countries is Haiti. Three days before making the above post, Secretary Noem announced she would terminate Haiti’s TPS designation as of February 3, 2026. Five Haitian TPS holders filed suit in federal court in Washington initially seeking an injunction against the termination of the Haitian TPS program pending the completion of the litigation. These plaintiff TPS holders are not “killers, leeches, or entitlement junkies.” They are instead a neuroscientist researching Alzheimer’s disease, a software engineer at a national bank, a laboratory assistant in a toxicology department, a college economics major, and a full-time registered nurse. The case was assigned to district court judge Ana Reyes who granted the plaintiffs’ injunction request on February 2, 2026, by way of an 83-page opinion. The plaintiffs charge that Secretary Noem preordained her termination decision because of hostility to non-white immigrants. According to Judge Reyes, “This seems substantially likely. Secretary Noem has terminated every TPS country designation to have reached her desk — twelve countries up, twelve countries down.” Judge Reyes also decided that Noem’s conclusion that Haiti (a majority non-white country) faces only “merely concerning” conditions cannot be squared with the “perfect storm” of “suffering and staggering” humanitarian toll described in page after page of the record in the case. In Judge Reyes’ view, Noem also ignored Congress’s requirement that she review the conditions in Haiti “after consulting with appropriate agencies.” Indeed, the record indicates she did not consult other agencies at all. Her “national interest” analysis focuses on Haitians outside the United States or here illegally, ignoring that Haitian TPS holders already live here and legally so. And though Noem states that the analysis must include “economic considerations,” Judge Reyes concluded Noem ignored altogether the billions that Haitian TPS holders contribute to the economy. The administration’s primary response in the litigation has been to assert that the TPS statute gives Secretary Noem “unbounded” discretion to make whatever determination she wants, any way she wants. Yes, Judge Reyes acknowledges, the statute does grant Noem some discretion. But, in Judge Reyes’ opinion, “not unbounded discretion.” To the contrary, Congress passed the TPS statute to standardize the then ad hoc temporary protection system; in Judge Reyes’ words, "to replace executive whim with statutory predictability.” The administration also argued that the harms to Haitian TPS holders were “speculative” if they are forced to return to Haiti. Because the State Department presently warns, “Do not travel to Haiti for any reason,” the administration asserts that harm is “speculative” only because DHS “might not” remove them. However, according to Judge Reyes, this argument fails to take Secretary Noem at her word: “We don’t want them. Not one.” The public interest also favors the injunction, in the opinion of Judge Reyes. Secretary Noem complains of the strains that unlawful immigrants place on our immigration-enforcement system. Noem’s answer is to turn 352,959 lawful TPS Haitian immigrants into unlawful immigrants overnight. Noem complains of strains to our economy; her answer is to turn employed lawful immigrants who contribute billions in taxes into the legally unemployable. Noem complains of strains to our health care system. Noem’s answer is to turn the insured into the uninsured. “This approach is many things – but the public interest is not one of them,” according to Judge Reyes. The opinion of Judge Reyes concludes: “Kristi Noem has a First Amendment right to call immigrants killers, leeches, entitlement junkies, and any other inapt name she wants. Secretary Noem, however, is constrained by both our Constitution and the law to apply faithfully the facts to the law in implementing the TPS program. The record to-date shows she has yet to do that. The administration has already appealed. John Christie was for many years a senior partner in a large Washington, D.C. law firm. He specialized in anti-trust litigation and developed a keen interest in the U.S. Supreme Court about which he lectures and writes.

Gov. Wes Moore signed legislation on February 17, 2026, to prohibit State and local jurisdictions from deputizing officers for federal civil immigration enforcement activity. The law, created under SB 245/HB 444 , is effective immediately. “In Maryland, we defend Constitutional rights and Constitutional policing — and we will not allow untrained, unqualified, and unaccountable ICE agents to deputize our law enforcement officers,” Moore said. “This bill draws a clear line: we will continue to work with federal partners to hold violent offenders accountable, but we refuse to blur the lines between state and federal authority in ways that undermine the trust between law enforcement and the communities they serve. Maryland is a community of immigrants, and that's one of our greatest strengths because this country is incomplete without each and every one of us.” “As an immigrant, this bill is deeply personal to me,” said Lt. Gov. Aruna Miller. “Immigrants make Maryland stronger every day, and our communities are safer when everyone feels protected and valued. This legislation ensures that our law enforcement resources remain focused on keeping Marylanders safe, not on actions that create fear in our neighborhoods. I thank the bill sponsors and Governor Moore for their leadership in ensuring Maryland remains a place where dignity and opportunity go hand in hand.” U.S. Department of Homeland Security Immigration and Customs Enforcement, also known as ICE, established its 287(g) program to authorize local law enforcement officials to perform federal civil immigration enforcement functions under ICE’s oversight. Under SB 245/HB 444, State and local jurisdictions in Maryland are prohibited from engaging in such agreements. Any local jurisdictions with standing 287(g) agreements must terminate them immediately. The legislation does not: Authorize the release of criminals Impact State policies and practices in response to immigration detainers that are issued by the U.S. Department of Homeland Security Prevent the State or local jurisdictions from continuing to work with the federal government on shared public safety priorities, including the removal of violent criminals who pose a risk to public safety Prevent State or local jurisdictions from continuing to notify ICE about the impending release of an individual of interest from custody or from coordinating the safe transfer of custody within constitutional limits State and local law enforcement will also maintain the ability to work with the federal government on criminal investigations and joint task forces unrelated to civil immigration enforcement. Any individual who is charged with a crime is entitled to due process and, if convicted, must serve their sentence.

When I practiced law, much of my litigation involved issues arising under federal antitrust laws. The Department of Justice (DOJ) was my frequent adversary in court. In some cases, DOJ challenged a client’s conduct as anticompetitive. In others, they claimed an intended client merger would create a monopoly. Some of these DOJ court battles were won, others were not. Overall, I had great respect for DOJ lawyers. They were professional, well prepared, and dedicated to their mission of seeing justice done. They were courteous, honest, and forthright with the courts before which we argued our cases. In those days, without resorting to social media or press conferences, the DOJ spoke entirely through its court filings. Although as an advocate I took issue with various DOJ investigatory decisions as well as decisions to initiate litigation, I never thought politics was involved. Post-Watergate internal rules strictly limited communication with any figures at the White House. Not so, it seems, anymore. Beginning last January 20, all of this changed rapidly and spectacularly . On March 14, Trump triumphantly arrived at the main DOJ building in D.C. to be welcomed by a group of carefully selected VIPs. He was greeted by Pam Bondi, his chosen new attorney general, who exclaimed, “We are so proud to work at the directive (sic) of Donald Trump.” Bondi’s boast that the DOJ now worked at the president’s behest was something never said before and, in effect, surrendered the department’s long and proud independence. And Bondi’s comment was not an empty gesture. As chronicled by reporters Carol Leonnig and Aaron Davis in their new book, Injustice: How Politics and Fear Vanquished America’s Justice Department , within hours of being sworn in, Trump and his lieutenants began punishing those at the Justice Department who had investigated him or those he considered his political enemies. Career attorneys with years of experience under many administrations were fired or reassigned to lesser work, or they resigned. As Leonnig and Davis report, what followed was “the wholesale overthrow of the Justice Department as Trump insert[ed] his dutiful former defense attorneys and 2020 election deniers atop the department.” [Source: Injustice , p. xix.] In the place of years of experience, the new team appears credentialed simply by loyalty to the president’s causes. The DOJ’s conduct in court has since caused damage to judicial and public faith in the integrity and competence of the department. Just Security is an independent, non-partisan, daily digital law and policy journal housed in the Reiss Center on Law and Security at the New York University School of Law. Since January 20, it has documented federal judicial concerns about DOJ conduct. In 26 cases, judges raised questions about DOJ non-compliance with judicial orders and in more than 60 cases, judges expressed distrust of government-provided information and representations. This count was taken the day after a federal court dismissed the DOJ cases against former FBI Director James Comey and New York Attorney General Letitia James. [Source: Just Security , “The ‘Presumption of Regularity’ in Trump Administration Litigation,” Nov. 20, 2025.] As summarized by the Georgetown Law Center’s Steve Vladeck, “It’s one thing for the Department of Justice to so transparently pursue a politically motivated prosecution. But this one has been beset from the get-go with errors that remotely competent law students wouldn’t make. Indeed, it seems a virtual certainty that the Keystone Kops-like behavior of the relevant government lawyers can be traced directly to the political pressure to bring this case; there’s a reason why no prosecutors with more experience, competence, or integrity were willing to take it on.” [Source: One First , Nov. 24, 2025.] Rather than accept criticism and instead of trying to do better, Bondi’s DOJ and the Trump administration lash out in a fashion apparently aimed at demeaning the federal judiciary. At a recent Federalist Society’s National Lawyers Convention, Deputy Attorney General Todd Blanche, one of Trump’s former defense attorneys, attributed the Trump administration’s myriad losses in the lower federal courts to “rogue activist judges.” He added, “There’s a group of judges that are repeat players, and that’s obviously not by happenstance, that’s intentional, and it’s a war, man.” Deputy Chief of Staff Stephen Miller decries each adverse ruling against the Trump administration as just part of a broader “judicial insurrection.” Not to be left behind, Trump himself regularly complains of “radical left lunatic” judges. In addition to the harm these comments inflict on the federal courts, their premise is simply not true. According to a survey by Vladeck, as of Nov. 14, there were 204 cases in which federal district courts have ruled on requests for preliminary relief against the Trump administration. In 154 of them, district judges granted either a temporary restraining order, a preliminary injunction, or both. Those 154 rulings came from 121 district judges appointed by seven presidents (including President Trump) in 29 district courts. In the 154 cases with rulings adverse to the Trump administration, 41 were presided over by 30 Republican-appointed judges, fully half of whom were appointed by President Trump. No, it is no longer your grandfather’s Department of Justice. John Christie was for many years a senior partner in a large Washington, D.C. law firm. He specialized in anti-trust litigation and developed a keen interest in the U.S. Supreme Court about which he lectures and writes.

The Salisbury City Council has appointed longtime public servant Melissa D. Holland to fill the vacancy in District 2. Holland was selected on Dec. 1 after the council reviewed several applicants. A 27-year resident of Salisbury, Holland brings more than 20 years of experience in government, education, and administration. As executive assistant to the president of the University of Maryland Center for Environmental Science, she currently oversees operations, budgeting, communications, and planning. Before joining UMCES, Holland worked for nearly 11 years with the Wicomico County Council, gaining extensive experience in legislative procedure, constituent services, research, and budget preparation. Her background includes positions with the Wicomico County Board of Education, the State of Maryland’s Holly Center, and multiple early-learning programs. Approved by a 3-1 council vote, Holland was selected based on her administrative expertise and long-standing community involvement. (Salisbury’s City Council is now comprised of only women.) She has a bachelor’s degree in legal studies from Post University and an associate degree from Wor-Wic Community College. She has also served as PTA president at East Salisbury Elementary and Wicomico Middle School. In her application, Holland emphasized her commitment to maintaining transparency in city government and ensuring that District 2 residents remain informed and represented. “I plan to be well-informed on the issues that matter to the citizens of Salisbury and to listen to their concerns carefully,” she wrote. “I want to make a positive and lasting impact on our city.” Holland’s appointment restores the City Council to full membership as it faces debates over budgeting, infrastructure planning, and local governance initiatives. She is expected to begin constituent outreach immediately and participate fully in the selection of the next council president.

Voters in Hurlock have delivered sweeping changes in this year’s municipal election, as Republican and GOP-aligned candidates won key races there. The results mark a setback for Democrats and a significant political shift in a community that has historically leaned Democratic in state and federal contests. The outcome underscores how local organizing and turnout strategies can have an outsized impact in small-town elections. Analysts also suggest that long-term party engagement in municipal contests could shape voter alignment in future county and state races. Political analysts warn that ignoring municipal elections and ceding them to the GOP could hurt the Maryland Democratic Party in statewide politics. Turnout increased by approximately 17% compared with the 2021 municipal election, reflecting heightened local interest in the mayoral and council races. Incumbent Mayor Charles Cephas, a Democrat, was soundly defeated by At-Large Councilmember Earl Murphy, who won with roughly 230 votes to Cephas’s 144. In the At-Large Council race, Jeff Smith, an independent candidate backed by local Republicans, secured a 15-point win over Cheyenne Chase. In District 2, Councilmember Bonnie Franz, a Republican, was re-elected by 40 percentage points over challenger Zia Ashraf, who previously served on the Dorchester Democratic Central Committee. The only Democrat to retain a seat on the council was David Higgins, who was unopposed. The Maryland Republican Party invested resources and campaign attention in the Hurlock race, highlighting it on statewide social media and dispatching party officials, including Maryland GOP Chair Nicole Beus Harris, to campaign. Local Democrats emphasized support for Mayor Cephas through the Dorchester County Democratic Central Committee, but the Maryland Democratic Party did not appear to participate directly.