Supreme Court Watch – How far is a President above the Law?

John Christie • April 15, 2020

President Trump has claimed, “I have an Article II [of the Constitution], where I have the right to do whatever I want as president.”

In three cases before the Supreme Court this term — Trump v. Mazars, Trump v. Deutsche Bank, and Trump v. Vance — the justices have the opportunity to decide just how far a president is above the law. The cases were to be argued on March 31 and ordinarily would have been decided by the end of June, but were put off due to the coronavirus situation. The Court announced on April 13 that oral arguments for a limited number of cases (including the Trump tax cases) will be heard by teleconference during the first two full weeks of May. Whether this delayed argument will affect the dates of the results — normally by the end of June — will probably remain unknown until we get to the end of June.

Three congressional committees, as well as prosecutors in New York, have issued subpoenas to Trump’s accountants and creditors for tax and business records, and Trump has sued to stop the firms from complying. Having lost twice at the district court level and twice at the appeals court level, Trump is seeking the Supreme Court’s review of those decisions. Although he sued as a private citizen, his appeals to the Supreme Court are supported by amicus briefs from the Department of Justice.

Mazars and Deutsche Bank involve congressional subpoenas for financial records concerning Trump, his family, and his businesses. After hearing evidence that Trump may not have complied with financial disclosure requirements, the House Oversight Committee subpoenaed Trump’s accounting firm for financial records to assist its evaluation of financial disclosure and conflict-of-interest laws. The Financial Services Committee subpoenaed records from two of Trump’s creditors to determine whether and how to strengthen federal banking laws. Finally, the Intelligence Committee subpoenaed financial records from Deutsche Bank as it investigated possible foreign entanglements. The committee is examining whether and how to prevent foreign interference in the U.S. political process, and also assessing the adequacy of intelligence resources.

The Court of Appeals concluded that these subpoenas “easily pass” the standards the Supreme Court has used when reviewing congressional subpoenas and were “reasonably framed” to help the committees conduct oversight and propose new legislation.

In Vance, a New York state grand jury issued a subpoena to the president’s accounting firm as part of a state criminal investigation into business transactions involving multiple individuals who may have violated state law. The subpoena sought financial and tax records — including for Trump and entities he owned before he became president — from January 2011 to August 2019.

In the lower courts and before the Supreme Court, the president’s lawyers have argued that he enjoys absolute immunity from all criminal process, an immunity so broad that it not only prevents indictment while serving as president, but prevents a third party (such as his accountants) from complying with a grand jury subpoena. However, in cases involving presidents Nixon and Clinton, the Supreme Court rejected similar arguments that a sitting president was broadly immune from an investigatory process.

Instead, the Court endorsed a balancing test that weighs the importance of the judicial process against any negative effect on the president’s ability to perform his constitutional functions. Here, only the president’s accountants must comply with the subpoena; the president is not required to do anything. In the Clinton case, the Court concluded that requiring a president to prepare for a deposition and give sworn testimony did not warrant even a postponement of that proceeding, let alone full immunity.

The Supreme Court has never invalidated a congressional subpoena, and recent Court decisions allowing investigations of presidents Nixon and Clinton while in office stand as strong precedents. Trump is obviously counting on the composition of today’s Supreme Court to save him. How the Court decides these three cases will tell us a lot about what kind of Supreme Court we have today.

John Christie was for many years a senior partner in a large Washington, D.C. law firm. He specialized in anti-trust litigation and developed a keen interest in the U.S. Supreme Court about which he lectures and writes.

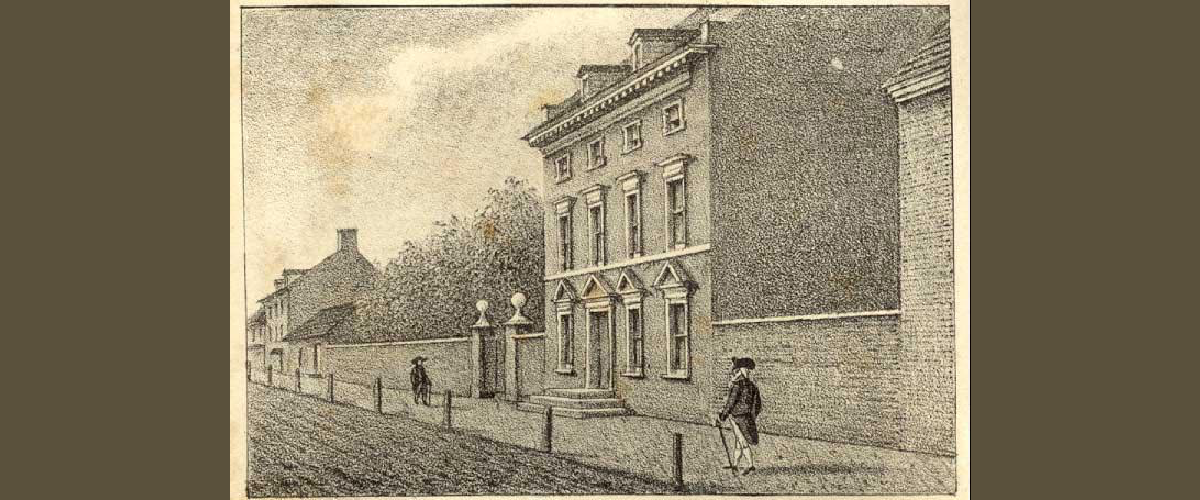

Common Sense for the Eastern Shore

Just up the road from Maryland’s Eastern Shore lies Independence National Historical Park in Philadelphia. Administered by the National Park Service (NPS), the park is dedicated to the preservation of historical structures and properties associated with the American Revolution and the founding and growth of the United States. The centerpiece of the park is Independence Hall, where the Declaration of Independence and the United States Constitution were debated and adopted by America's Founding Fathers in the late 18th century. Nearby is the Liberty Bell, an iconic symbol of American independence, displayed in the Liberty Bell Center. In the park as well is what’s called the President’s House, an exhibit on the site of the first official residence of the president of the United States. President Washington occupied the Philadelphia President's House from 1790 to 1797. His successor, John Adams, lived there from 1797 to 1800. Although the original structure no longer exists, the exhibit includes a view of the foundation of the house where our first two presidents lived with their families. Research has turned up information about nine enslaved Africans owned by Washington and brought to Philadelphia’s presidential residence during his time there. To commemorate the lives of those slaves, their names are etched in a wall in the exhibit: Oney Judge, Austin, Christopher Sheels, Giles, Hercules Posey, Joe Richardson, Moll, Paris, and Richmond. The site includes exhibits on how their struggles for freedom represented this country’s progress away from the horrors of slavery and into an era where the founding ideals of “Life, Liberty and the pursuit of Happiness” could be achieved for every American. An intended theme of the President’s House exhibit is “Liberty: The Promises and Paradoxes.” “The promises of liberty and equality granted in the founding documents present a paradox: not only were they ideals to strive for but they were unfulfilled promises for people who struggled to be fully included as citizens of our nation.” ------------------------------------------------------------ On March 27, 2025, President Trump signed Executive Order 14253, “Restoring Truth and Sanity to American History.” EO14253 stated in part: “Over the past decade, Americans have witnessed a concerted and widespread effort to rewrite our nation's history, replacing objective facts with a distorted narrative driven by ideology rather than truth.” In order to “restore truth in American history,” EO14253 directed the Secretary of the Interior to ensure that all public monuments, memorials, or similar properties within the Department of the Interior's jurisdiction do not contain descriptions or other content that “inappropriately disparage” Americans past or living (including persons living in colonial times) and instead focus on the greatness of the achievements and progress of the American people. In response to this order, on January 22, 2026, the NPS suddenly removed 34 educational panels and video exhibits that referenced slavery and provided information about the individuals enslaved at the President’s House. The day these exhibits were removed, the City of Philadelphia filed a lawsuit in the federal district court in Philadelphia against Secretary of the Interior Doug Burgum, the Department of the Interior, Acting Director of NPS Jessica Bowron, and the NPS itself, claiming that the removal of the displays was unlawful agency action. On February 16, Judge Cynthia Rufe ordered the Trump administration to restore the slavery-related exhibits at the national park site, holding that NPS lacked the power “to dissemble and disassemble historical truths.” In court, the government asserted it alone had the power to erase, alter, remove, and hide historical accounts on taxpayer and local government-funded monuments within its control. According to Judge Rufe, to claim that “truth is no longer self-evident, but rather the property of the elected chief magistrate and his appointees and delegees, at his whim to be scraped clean, hidden, or overwritten” comes right out of George Orwell’s 1984. In her opinion, no government agency can “arbitrarily” decide what is true, “based on its own whims or the whims of the new leadership.” “It is not disputed that President Washington owned slaves.” Moreover, Judge Rufe determined the removed displays were not mere decorations to be taken down and redisplayed; rather, they were a memorial to the “men, women, and children of African descent who lived, worked, and died as enslaved people in the United States of America.” Each person who visits the President’s House and does not learn of the realities of founding-era slavery receives a false account of this country’s history. Removal of the crucial interpretive materials strips the site of that truth and deprives the public of educational opportunities designed to be free and accessible. For Judge Rufe, the abrupt elimination of historically significant educational material is like “pulling pages out of a history book with a razor.” John Christie was for many years a senior partner in a large Washington, D.C. law firm. He specialized in anti-trust litigation and developed a keen interest in the U.S. Supreme Court about which he lectures and writes.

Last month, Megan Outten, candidate for Wicomico County Council District 7, was endorsed by Run for Something (RFS), a national organization that recruits and supports the next generation of progressive leaders for state and local office. The organization’s slate of newly endorsed candidates includes young, diverse progressives from across the country who are ready to lead in their communities. Outten said, “This campaign has always been powered by our community. By parents, teachers, small business owners, and neighbors who know we can do better. Run for Something’s endorsement affirms what we already know here in Wicomico: when everyday people step up to lead, we change what’s possible. Together, we’re building the kind of local government that plans ahead, listens first, and puts families at the center of every decision.” “Bold leaders like Megan are at the forefront of the fight for our rights and freedoms at a time when they have never faced greater threats,” said Amanda Litman, Co-Founder and President of Run for Something. “Run for Something is proud to endorse Megan Outten as part of our latest class of young leaders working to secure lasting change in their communities.” Outten’s platform is rooted in real data and shaped by direct community engagement. With Wicomico now the fastest-growing school system on Maryland’s Eastern Shore, and 85% of students relying on additional resources, she points to the county’s lagging investment as a key area for action. “Strong schools lead to strong jobs, thriving industries, and healthier communities,” Outten said. “Our schools and infrastructure are at a tipping point. We need leadership that stops reacting after things break — and starts investing before they do.” About Run for Something: Amanda Litman and Ross Morales Rocketto launched RFS in January 2017 with a simple premise: to help young, diverse progressives run for state and local offices in order to build a bench for the future. RFS aims to lower the barriers to entry for these candidates by helping them with organization building, connecting them with a robust community, and providing access to the trainings they need to be successful. Since its founding, RFS has helped elect over 1,600 candidates across the country — including 43 candidates in red-to-blue seats in the 2025 election cycle. Today, RFS has the largest database of any Democratic organization, with nearly 80,000 people reaching out since November 2024 with interest in running for office. In total, over 250,000 young people from across the country have signed up to run and gained access to RFS’s resources since the organization launched — a powerful signal that a new generation is showing up to lead.

The Trump administration is still arresting immigrants in D.C. without warrants or probable cause despite a judge’s previous ruling that the practice was unlawful, a coalition of immigrant rights groups alleges in a recent court filing. A federal judge ruled in December that the administration’s use of warrantless immigration arrests likely violated federal law and issued a preliminary injunction prohibiting such arrests without probable cause. The ruling was in response to a lawsuit filed by immigrant rights groups and four migrants who were arrested without warrants last year during President Donald Trump’s law enforcement surge in the capital. But federal immigration officials in D.C. are failing to comply with that order, continuing to make warrantless arrests “without the required probable cause determinations,” according to the Feb. 19 motion by plaintiffs. The lawsuit alleges immigration authorities began operating under an “arrest first, ask questions later” policy to comply with arrest quotas imposed after Trump took office last year — and started to ignore the probable cause requirements under immigration law. Click here to read the rest of the article , on the Capital News Service website. The article also details the arrest stories of the plaintiffs who were tricked, and concerns about D.C. police cooperation with immigration authorities. Capital News Service is a student-powered news organization run by the University of Maryland Philip Merrill College of Journalism. For 26 years, they have provided deeply reported, award-winning coverage of issues of import to Marylanders.

These are the words from Emma Lazarus’ famous 1883 sonnet “The New Colossus” inscribed on a bronze plaque on the pedestal of the Statue of Liberty. In 1990, Congress reaffirmed this vision of America by establishing the Temporary Protected Status program. TPS is designed to provide humanitarian relief to foreign nationals in the United States who come from disaster-stricken countries. In its present form, the TPS legislation gives the Secretary of the Department of Homeland Security responsibility for the program. However, the legislation prescribes the kind of country conditions severe enough to warrant a designation under the statute, the specific time frame for any such designation, and the process for periodic review of a TPS designation which could culminate in termination or extension. All initial TPS designations last from six to eighteen months. Before the expiration of a designation, the statute mandates that the Secretary shall review the conditions in the foreign state to decide if the conditions for the designation continue to be met, following consultation with appropriate agencies of the government. Extension is the default; the designation “shall be extended” unless the secretary affirmatively determines that conditions are “no longer met.” ------------------------------------------------------------- A massive earthquake devastated Haiti in January 2010, and precipitated an unprecedented humanitarian crisis. Shortly after, then-DHS Secretary Janet Napolitano, after consultation with the State Department, designated Haiti for TPS due to “extraordinary conditions.” Haitian nationals in the United States continuously as of January 12, 2010, could thus apply for TPS, and obtained the right to remain and work in the U.S. while Haiti maintained its TPS designation. Napolitano set the initial TPS designation for 18 months. As Haiti’s deterioration worsened, successive DHS secretaries have extended this program. Gang violence and kidnappings have spiked. In 2021, a group of assailants killed Haiti’s then-President Jovenel Moïse. In 2023, another catastrophic earthquake hit Haiti. In 2024, in response to these conditions, then-DHS Secretary Alejandro Mayorkas once again extended and redesignated Haiti for TPS, this time effective through February 3, 2026. During the 2024 election cycle, the GOP candidate, Donald Trump clearly indicated that time had not tempered his views on Haiti, characterized by him as a “shithole country” during his first term. He stated that when elected, he would “absolutely revoke” Haiti’s TPS designation and send “them back to their country.” On December 1, 2025, Kristi Noem, DHS secretary in the second Trump administration, announced, “I just met with the president. I am recommending a full travel ban on every damn country that’s been flooding our nation with killers, leeches, and entitlement junkies. Our forefathers built this nation on blood, sweat, and the unyielding love of freedom, not for foreign invaders to slaughter our heroes, suck dry our hard-earned tax dollars, or snatch the benefits owned to Americans. We don’t want them, not one.” So says the official responsible for overseeing the TPS program. And one of those (her word) “damn” countries is Haiti. Three days before making the above post, Secretary Noem announced she would terminate Haiti’s TPS designation as of February 3, 2026. Five Haitian TPS holders filed suit in federal court in Washington initially seeking an injunction against the termination of the Haitian TPS program pending the completion of the litigation. These plaintiff TPS holders are not “killers, leeches, or entitlement junkies.” They are instead a neuroscientist researching Alzheimer’s disease, a software engineer at a national bank, a laboratory assistant in a toxicology department, a college economics major, and a full-time registered nurse. The case was assigned to district court judge Ana Reyes who granted the plaintiffs’ injunction request on February 2, 2026, by way of an 83-page opinion. The plaintiffs charge that Secretary Noem preordained her termination decision because of hostility to non-white immigrants. According to Judge Reyes, “This seems substantially likely. Secretary Noem has terminated every TPS country designation to have reached her desk — twelve countries up, twelve countries down.” Judge Reyes also decided that Noem’s conclusion that Haiti (a majority non-white country) faces only “merely concerning” conditions cannot be squared with the “perfect storm” of “suffering and staggering” humanitarian toll described in page after page of the record in the case. In Judge Reyes’ view, Noem also ignored Congress’s requirement that she review the conditions in Haiti “after consulting with appropriate agencies.” Indeed, the record indicates she did not consult other agencies at all. Her “national interest” analysis focuses on Haitians outside the United States or here illegally, ignoring that Haitian TPS holders already live here and legally so. And though Noem states that the analysis must include “economic considerations,” Judge Reyes concluded Noem ignored altogether the billions that Haitian TPS holders contribute to the economy. The administration’s primary response in the litigation has been to assert that the TPS statute gives Secretary Noem “unbounded” discretion to make whatever determination she wants, any way she wants. Yes, Judge Reyes acknowledges, the statute does grant Noem some discretion. But, in Judge Reyes’ opinion, “not unbounded discretion.” To the contrary, Congress passed the TPS statute to standardize the then ad hoc temporary protection system; in Judge Reyes’ words, "to replace executive whim with statutory predictability.” The administration also argued that the harms to Haitian TPS holders were “speculative” if they are forced to return to Haiti. Because the State Department presently warns, “Do not travel to Haiti for any reason,” the administration asserts that harm is “speculative” only because DHS “might not” remove them. However, according to Judge Reyes, this argument fails to take Secretary Noem at her word: “We don’t want them. Not one.” The public interest also favors the injunction, in the opinion of Judge Reyes. Secretary Noem complains of the strains that unlawful immigrants place on our immigration-enforcement system. Noem’s answer is to turn 352,959 lawful TPS Haitian immigrants into unlawful immigrants overnight. Noem complains of strains to our economy; her answer is to turn employed lawful immigrants who contribute billions in taxes into the legally unemployable. Noem complains of strains to our health care system. Noem’s answer is to turn the insured into the uninsured. “This approach is many things – but the public interest is not one of them,” according to Judge Reyes. The opinion of Judge Reyes concludes: “Kristi Noem has a First Amendment right to call immigrants killers, leeches, entitlement junkies, and any other inapt name she wants. Secretary Noem, however, is constrained by both our Constitution and the law to apply faithfully the facts to the law in implementing the TPS program. The record to-date shows she has yet to do that. The administration has already appealed. John Christie was for many years a senior partner in a large Washington, D.C. law firm. He specialized in anti-trust litigation and developed a keen interest in the U.S. Supreme Court about which he lectures and writes.

Gov. Wes Moore signed legislation on February 17, 2026, to prohibit State and local jurisdictions from deputizing officers for federal civil immigration enforcement activity. The law, created under SB 245/HB 444 , is effective immediately. “In Maryland, we defend Constitutional rights and Constitutional policing — and we will not allow untrained, unqualified, and unaccountable ICE agents to deputize our law enforcement officers,” Moore said. “This bill draws a clear line: we will continue to work with federal partners to hold violent offenders accountable, but we refuse to blur the lines between state and federal authority in ways that undermine the trust between law enforcement and the communities they serve. Maryland is a community of immigrants, and that's one of our greatest strengths because this country is incomplete without each and every one of us.” “As an immigrant, this bill is deeply personal to me,” said Lt. Gov. Aruna Miller. “Immigrants make Maryland stronger every day, and our communities are safer when everyone feels protected and valued. This legislation ensures that our law enforcement resources remain focused on keeping Marylanders safe, not on actions that create fear in our neighborhoods. I thank the bill sponsors and Governor Moore for their leadership in ensuring Maryland remains a place where dignity and opportunity go hand in hand.” U.S. Department of Homeland Security Immigration and Customs Enforcement, also known as ICE, established its 287(g) program to authorize local law enforcement officials to perform federal civil immigration enforcement functions under ICE’s oversight. Under SB 245/HB 444, State and local jurisdictions in Maryland are prohibited from engaging in such agreements. Any local jurisdictions with standing 287(g) agreements must terminate them immediately. The legislation does not: Authorize the release of criminals Impact State policies and practices in response to immigration detainers that are issued by the U.S. Department of Homeland Security Prevent the State or local jurisdictions from continuing to work with the federal government on shared public safety priorities, including the removal of violent criminals who pose a risk to public safety Prevent State or local jurisdictions from continuing to notify ICE about the impending release of an individual of interest from custody or from coordinating the safe transfer of custody within constitutional limits State and local law enforcement will also maintain the ability to work with the federal government on criminal investigations and joint task forces unrelated to civil immigration enforcement. Any individual who is charged with a crime is entitled to due process and, if convicted, must serve their sentence.