These Four Challenges will Shape the Next Farm Bill — and How the U.S. Eats

For the 20th time since 1933, Congress is writing a multiyear farm bill that will shape what kind of food U.S. farmers grow, how they raise it and how it gets to consumers. These measures are large, complex and expensive: The next farm bill is projected to cost taxpayers US$1.5 trillion over 10 years.

Modern farm bills address many things besides food, from rural broadband access to biofuels and even help for small towns to buy police cars. These measures bring out a dizzying range of interest groups with diverse agendas.

Umbrella organizations like the American Farm Bureau Federation and the National Farmers Union typically focus on farm subsidies and crop insurance. The National Sustainable Agriculture Coalition advocates for small farmers and ranchers. Industry-specific groups, such as cattlemen , fruit and vegetable growers and organic producers , all have their own interests.

Environmental and conservation groups seek to influence policies that affect land use and sustainable farming practices. Hunger and nutrition groups target the bill’s sections on food aid. Rural counties , hunters and anglers , bankers and dozens of other organizations have their own wish lists.

As a former Senate aide and senior official at the U.S. Department of Agriculture, I’ve seen this intricate process from all sides. In my view, with the challenges in this round so complex and with critical 2024 elections looming, it could take Congress until 2025 to craft and enact a bill. Here are four key issues shaping the next farm bill, and through it, the future of the U.S. food system.

The price tag

Farm bills always are controversial because of their high cost, but this year the timing is especially tricky. In the past two years, Congress has enacted major bills to provide economic relief from the COVID-19 pandemic , counter inflation , invest in infrastructure and boost domestic manufacturing.

These measures follow unprecedented spending for farm support during the Trump administration. Now legislators are jockeying over raising the debt ceiling , which limits how much the federal government can borrow to pay its bills.

Agriculture Committee leaders and farm groups argue that more money is necessary to strengthen the food and farm sector. If they have their way, the price tag for the next farm bill would increase significantly from current projections.

On the other side, reformers argue for capping payments to farmers , which The Washington Post recently described as an “expensive agricultural safety net ,” and restricting payment eligibility. In their view, too much money goes to very large farms that produce commodity crops like wheat, corn, soybeans and rice, while small and medium-size producers receive far less support.

Food aid is the key fight

Many people are surprised to learn that nutrition assistance – mainly through the Supplemental Nutrition Assistance Program , formerly known as food stamps – is where most farm bill money is spent. Back in the 1970s, Congress began including nutrition assistance in the farm bill to secure votes from an increasingly urban nation.

Today, over 42 million Americans depend on SNAP , including nearly 1 in every 4 children. Along with a few smaller programs, SNAP will likely consume 80% of the money in the new farm bill, up from 76% in 2018.

Why have SNAP costs grown? During the pandemic, SNAP benefits were increased on an emergency basis, but that temporary arrangement expired in March 2023. Also, in response to a directive included in the 2018 farm bill, the Department of Agriculture recalculated what it takes to afford a healthy diet, known as the Thrifty Food Plan , and determined that it required an additional $12-$16 per month per recipient, or 40 cents per meal.

Because it’s such a large target, SNAP is where much of the budget battle will play out. Most Republicans typically seek to rein in SNAP; most Democrats usually support expanding it.

Anti-hunger advocates are lobbying to make the increased pandemic benefits permanent and defend the revised Thrifty Food Plan. In contrast, Republicans are calling for SNAP reductions, and are particularly focused on expanding work requirements for recipients.

Debating climate solutions

The 2022 Inflation Reduction Act provided $19.5 billion to the Department of Agriculture for programs that address climate change. Environmentalists and farmers alike applauded this investment , which is intended to help the agriculture sector embrace climate-smart farming practices and move toward markets that reward carbon sequestration and other ecosystem services.

This big pot of money has become a prime target for members of Congress who are looking for more farm bill funding. On the other side, conservation advocates, sustainable farmers and progressive businesses oppose diverting climate funds for other purposes.

There also is growing demand for Congress to require USDA to develop better standards for measuring, reporting and verifying actions designed to protect or increase soil carbon. Interest is rising in “ carbon farming ” – paying farmers for practices such as no-till agriculture and planting cover crops , which some studies indicate can increase carbon storage in soil.

But without more research and standards, observers worry that investments in climate-smart agriculture will support greenwashing – misleading claims about environmental benefits – rather than a fundamentally different system of production. Mixed research results have raised questions as to whether establishing carbon markets based on such practices is premature.

A complex bill and inexperienced legislators

Understanding farm bills requires highly specialized knowledge about issues ranging from crop insurance to nutrition to forestry. Nearly one-third of current members of Congress were first elected after the 2018 farm bill was enacted, so this is their first farm bill cycle.

I expect that, as often occurs in Congress, new members will follow more senior legislators’ cues and go along with traditional decision making. This will make it easier for entrenched interests, like the American Farm Bureau Federation and major commodity groups, to maintain support for Title I programs , which provide revenue support for major commodity crops like corn, wheat and soybeans. These programs are complex, cost billions of dollars and go mainly to large-scale operations.

Agriculture Secretary Tom Vilsack’s current stump speech spotlights the fact that 89% of U.S. farmers failed to make a livable profit in 2022, even though total farm income set a record at $162 billion. Vilsack asserts that less-profitable operations should be the focus of this farm bill – but when pressed, he appears unwilling to concede that support for large-scale operations should be changed in any way.

When I served as deputy secretary of agriculture from 2009 to 2011, I oversaw the department’s budget process and learned that investing in one thing often requires defunding another. My dream farm bill would invest in three priorities: organic agriculture as a climate solution ; infrastructure to support vibrant local and regional markets and shift away from an agricultural economy dependent on exporting low-value crops; and agricultural science and technology research aimed at reducing labor and chemical inputs and providing new solutions for sustainable livestock production.

In my view, it is time for tough policy choices, and it won’t be possible to fund everything. Congress’ response will show whether it supports business as usual in agriculture, or a more diverse and sustainable U.S. farm system.![]()

Kathleen Merrigan , Executive Director, Swette Center for Sustainable Food Systems, Arizona State University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

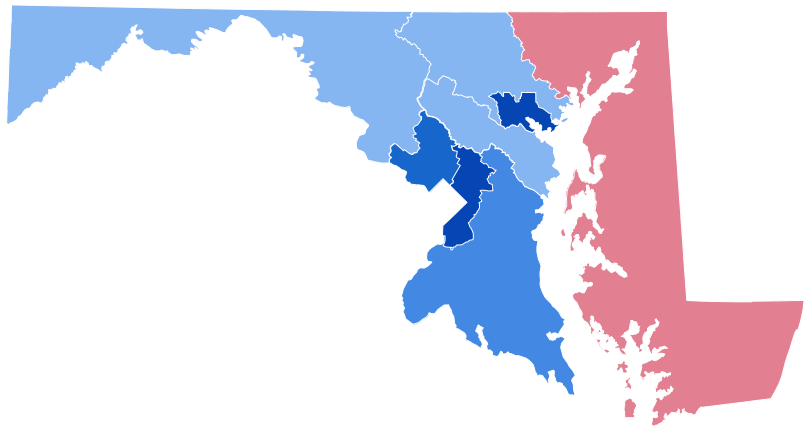

Common Sense for the Eastern Shore