The Truth About the FY2026 Md. Budget HB350

After over 12 hours of debate over two days (and a whole circus from the other side), the Maryland House of Delegates has passed HB 350, this year's state budget, and sent it to the State Senate.

This budget is a deal between House Democrats, Senate Democrats, and Governor Wes Moore. It faces our state's $3 billion deficit head-on not with fantasy math, but with real choices: smart cuts and fair new revenue. This is what grown-up governing looks like.

How We Got Here:

Maryland’s budget problems didn’t start overnight. Leaders began warning about a shortfall in 2017 when Governor Larry Hogan was in office.

Hogan made our state budget bigger every year, but the legislature wasn’t allowed to move money around or make common-sense changes. By law, they could only make cuts. In 2020, Maryland voters changed that. Starting in 2023, lawmakers finally got full power to shape the budget, not just cut from it.

Instead of fixing the problem, Governor Hogan used federal COVID relief to hide our fiscal instability. Then, before leaving office, he drained our state’s savings from $5.5 billion to $2.3 billion to boost his image.

Today, we are facing a new fiscal arsonist. Donald Trump’s trade wars and cuts to federal programs hit Maryland hard. We have more federal jobs and agencies than any other state, so we felt it worse than most. A University of Maryland study says Trump’s tariffs alone could cost us $2 billion.

Trump/Musk's policies caused over 30,000 people in Maryland to lose their jobs, offices to shut down, and promised investments to disappear. These federal cuts added another $300 million to our budget deficit.

COVID relief gave us a short break and even created a fake surplus under Hogan, but that money is gone now. Meanwhile, housing, healthcare, and college prices have gone way up.

The Trump–Musk White House is making it worse by cutting even more funding, eliminating research, and gutting the services we rely on.

That’s why Maryland had to act. We needed a real plan to protect working people, fund our schools and hospitals, and keep our state strong.

Why Cuts Were Needed

Trump’s trade wars and cuts to federal agencies hit Maryland harder than any other state. A University of Maryland study says those tariffs alone could cost us $2 billion.

That hurts real people:

- A chicken farmer on the Eastern Shore is paying 25% more for fertilizer.

- A dock worker in Baltimore has fewer ships to unload.

- A restaurant owner in Western Maryland can’t afford eggs and tomatoes.

We’ve lost over 30,000 jobs. Offices have shut down. Promised investments disappeared.

The decisions of the Trump/Musk administration added $300 million to our state deficit.

What the Budget Actually Does

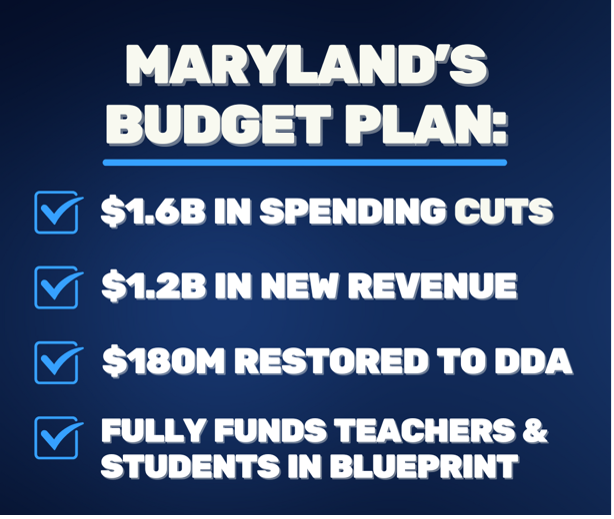

This budget:

- Cuts $1.6 billion responsibly

- Raises $1.3 billion in fair new revenue

- Leaves a $350 million surplus

- Builds over $2 billion in rainy day savings

- Protects funding for schools, health care, transit, and public workers

And here’s the best part:

94% of Marylanders will see a tax cut or no change at all. Only the wealthiest 5%, the folks who’ve been dodging taxes for years, will finally chip in like the rest of us.

We’re also updating our tax code:

- Taxing IT and data services (just like Texas and D.C.)

- Raising taxes on things like cannabis and sports betting, not groceries or medicine

- Letting local governments raise income taxes slightly if they choose

Who Pays More?

This plan asks the ultra-wealthy to do their part:

- People making over $750,000 will pay a little more

- Millionaires will pay 6.5%

- Capital gains over $350,000 will face a 2% surcharge

- Deductions are capped for high earners

Working people still get to write off medical debt, student loan interest, and charitable donations. That’s real relief.

What’s NOT In the Budget?

There’s no new tax on:

- Soda or sugary drinks

- Small businesses

- Retail delivery (like Amazon or DoorDash)

- Gas, estate tax, or car trade-ins

- Property

- iGaming (online gambling)

And there are no cuts to:

- Services for people with disabilities

- Public schools

- Health care

- State jobs

Bottom Line

This budget doesn’t just fix a crisis, it builds a better future. It protects what matters most and puts the burden where it belongs: on the folks who can afford it.

This budget invests in world-class public schools, better transit, and strong protections for working families. There are no gimmicks or games—just smart, responsible leadership.

Feel free to share this information to push back on some misleading narratives the far-right is pushing.

In Solidarity,

Jared Schablein

https://www.facebook.com/ShoreProgress/

Salisbury MD

Jared Schablein is chair of Shore Progress.

Common Sense for the Eastern Shore