In the Chesapeake Bay, an Island is Reborn One Stone at a Time

Though hard to imagine now, Barren Island once boasted more than a dozen farms, a church, a schoolhouse, and a handful of stores.

Now that the island has dissolved into a few dollops of land along the eastern edge of the Chesapeake Bay, it truly lives up to its name. It’s barren! Its last residents fled a century ago and the hunting lodge built in their wake has long since disappeared.

Yet, beginning last March, the remote archipelago has been a hive of construction, plus equipment, barges, and hard hats. Boulder by boulder, a new shield is taking shape from one end of to the other.

The project was sidelined for years by lack of funding from Congress. Had it been delayed longer, there would not have been much island left to save, said Trevor Cyran, project manager for the U.S. Army Corps of Engineers.

“Climate change is a big driver of erosion here, which drives increased wave energy,” he said during a progress inspection in mid-August. “This will establish and stabilize the island much better, as well as create additional acreage of wetlands.”

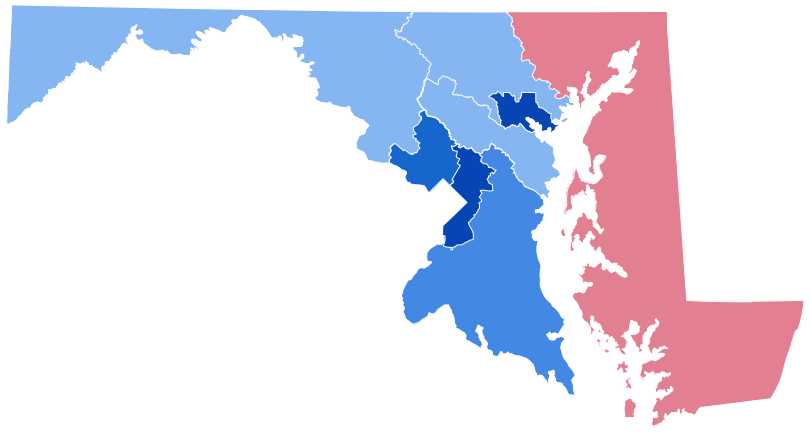

Barren Island lies just west of Upper Hoopers Island in Dorchester County, Md. The only way on and off is by boat, and even that is tricky because there is no dock, just acre upon acre of eroding marsh and pine woods.

The Army Corps estimates that Barren loses 3–4 feet of land per year to erosion. Over the past two decades, more than 40 acres has been lost, nearly one-fourth of the island.

The $43 million first phase of Barren’s restoration, now underway, includes constructing about two miles of stone barriers, mostly along the island’s western shore. A 4,600-foot-long breakwater will also be raised to about eight feet above the average water level, adding further protection.

Over 30% of phase one construction has been completed, according to the U.S. Army Corps of Engineers. Completion is expected by this October.

The next two phases will pipe in dredged material from channels in local rivers to create as much as 83 acres of wetlands behind new barrier walls. Engineers also plan to create two “bird islands” totaling nearly nine acres of new land behind the extended barrier, just south of Barren.

Additional congressional approval is needed to fund the final two phases, Cyran said. The cost of all three phases will be $200 million.

One project goal is to provide erosion protection to the fishing village of Hooper’s Island to its east, Cyran said. Another is to replace rapidly vanishing wildlife habitat. The U.S. Fish and Wildlife Service manages most of the island as part of the Chesapeake Marshlands National Wildlife Refuge Complex.

“When this project is complete, it’s for the birds, the fish, and the reptiles,” he added. “The intent is to give it back to nature.”

Barren Island is the first step in the Mid-Chesapeake Bay Island Ecosystem Restoration. This overall $2 billion project is centered on rebuilding an island in the mouth of the Choptank River, about 13 miles north of Barren.

Measured by acres, the James Island restoration will be 25 times the size of Barren Island. Dredged material from the approach channels to the Port of Baltimore and the Chesapeake and Delaware Canal will transform 2,100 acres of open water into dry land. Construction will be adjacent to the remnants of existing James Island, which is privately owned.

Dredged material from those channels is currently offloaded at Poplar Island, about 15 miles north of James. Since the 1990s, this island off Talbot County has grown into the Army Corps’ largest dredged material “beneficial use” project undertaken on the East Coast.

Poplar Island will reach its 1,715-acre capacity around 2030, which will require moving to James, said Amanda Peñafiel, project manager for the Maryland Port Administration.

“The Port Administration feels like this project is a win-win for the State of Maryland,” she said. “We are reusing dredged material to restore remote island habitat while keeping federal navigation channels clear, which ultimately keeps the port open for business.”

The federal government is paying 65% of the project cost, with Maryland picking up the rest.

This article was originally published in the Bay Journal, a non-profit news source that provides the public with independent reporting on environmental news and issues in the Chesapeake Bay watershed.

Common Sense for the Eastern Shore