The Scramble for Vaccine and Herd Immunity

In mid-January, Phase 1B of the roll-out started. That phase extended vaccine eligibility beyond medical personnel, first responders, and the residents and staff of nursing homes. Now older people and those at higher risk could — in theory — get the vaccine. In practice, however, people are spending long hours trying to navigate complicated online vaccine registration systems only to be told there are no appointments available. Calls to vaccine numbers have gone unanswered or just referred desperate people back to the same clogged registration systems. Those who did manage to get vaccine appointments often had those appointments canceled due to numerous problems including weather, lack of vaccine, lack of vaccine supplies such as needles, and lack of enough people trained to administer the shots. It’s been frustrating for all involved.

Despite this stumbling start to the massive national vaccination program, progress has been made and the kinks in the system are slowly being ironed out.

As of now, mid-February, over 30 million people in the U.S. have received a first dose and close to seven million of those have received their second dose. Only another 300 million people to go! Which means that in the U.S., we need 600 million doses of vaccine since it takes two shots to achieve a strong immune response.

The good news is that the federal government has now contracted for all 600 million doses. They are scheduled to arrive by late May or early June. With luck, they will all be in arms by fall 2021 and we can start getting back to normal.

Currently, as of February 11, U.S. providers are vaccinating approximately 1.5 million people per day. That’s well over the goal set by the Biden administration of one million shots per day during the first 100 days. It’s also a significant increase from the 1.1 million vaccinated per day at the beginning of February.

However, the U.S. is still far behind several other countries. Leading the world as of February 11 is Israel, where over 65 percent of the population has received at least one shot. The island nation of the Seychelles at 46 percent, the United Arab Republics at 44 percent, and the United Kingdom at 20 percent are all ahead of us. In the U.S., around 12 percent have been vaccinated.

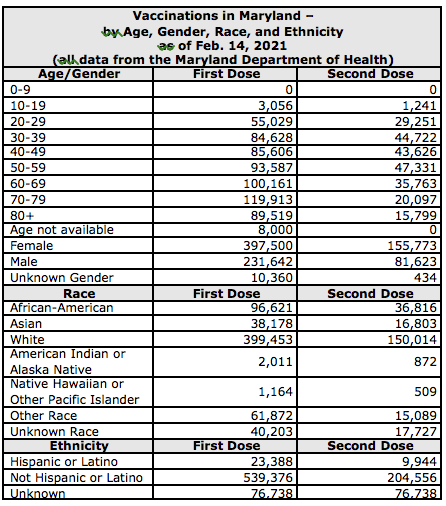

In Maryland as of February 14, just under 880,000 vaccines have been given. That represents 639,502 initial shots and 237,830 second doses. That’s almost 11 percent of the state’s population with one dose and almost 4 percent with two shots. A little over 22,000 of those vaccinations have been on the Eastern Shore.

The number of vaccine doses allotted per week to each Maryland county is calculated based on population. Since most Eastern Shore counties have relatively small populations, all except Cecil and Wicomico counties receive the minimum number of first doses, which is 300 per week, supplies permitting. Cecil and Wicomico are each allotted 700 doses per week. Below is a table showing the number of weekly vaccine doses that each county is supposed to receive. Several times, the state has not received their full allotment from the federal government and thus the local deliveries of vaccine were reduced.

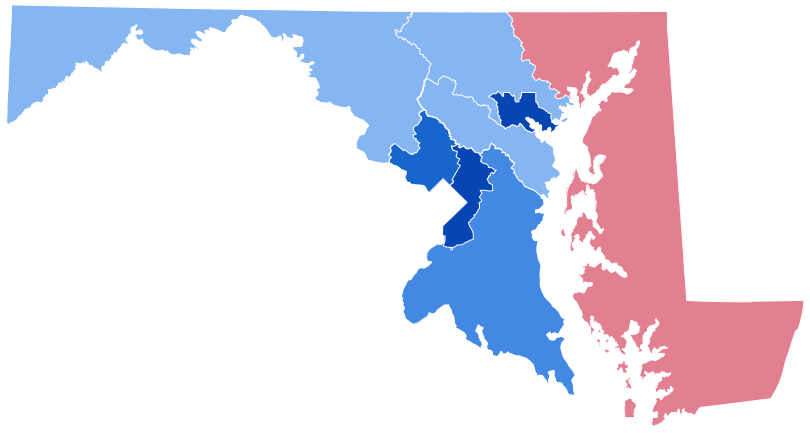

This is one time when having a smaller population actually confers a political advantage. Because 300 doses is the minimum distribution, that turns out to be a bigger allotment per person than in heavily populated areas. Thus some of the smaller Eastern Shore counties have been able to vaccinate a higher percentage of their people. As of February 14, Kent County at 20 percent has the highest percentage of its population vaccinated with at least a first dose. Worcester County is second with 17 percent vaccinated. Talbot County is third at just under 17 percent. The lowest vaccination rate in the state to date is Prince George’s County on the Western Shore at 5 percent. Charles County and Baltimore City, also on the other side of the bay, are second and third lowest at 7 percent and 9 percent respectively. Cecil and Somerset counties are the lowest on the Eastern Shore with 9 percent and 10 percent vaccinated.

The Maryland Department of Health requires a certain percentage of each week’s allotment to go to teachers and other education personnel. For the seven Eastern Shore counties receiving 300 doses per week, that means 100 doses per week to education. Other requirements may be in place. In Kent County for example, 50 more of those first doses are reserved for those in continuity of government. In addition, 75 doses are reserved for seniors needing assistance. The remaining 75 available vaccine appointments are posted publicly on Wednesday mornings. These appointments are generally snapped up within 10 minutes or less. Those snagging an appointment should check for requirements but generally a government ID, proof of age and residency, and insurance cards are required along with proof of employment if the person is eligible for the vaccine due to their job in an essential occupation.

Medical experts all agree that 70-90 percent of a population need to be vaccinated for herd immunity to be attained. So we still have a long way to go. But, barring unforeseen difficulties, it can be done by fall. So hang in there. For seniors experiencing difficulty getting an appointment for the vaccine, check out the list in this companion article.

Sources and more information:

“Rate of COVID-19 vaccination worldwide as of February 11, 2021, by country” (per 100 people)”

“See How the Vaccine Rollout Is Going in Your State” Updated Feb. 13, 2021

Maryland Department of Health; Updates on Maryland’s COVID-19 Vaccine Plan (Week 9 Allocation).

”With More Vaccines Secured, Biden Warns of Hurdles to Come”

“Vaccinations in Maryland” Maryland Department of Health Covid-19 Data Dashboard

Jane Jewell is a writer, editor, photographer, and teacher. She has worked in news, publishing, and as the director of a national writer's group. She lives in Chestertown with her husband Peter Heck, a ginger cat named Riley, and a lot of books.

Common Sense for the Eastern Shore